dupage county sales tax 2021

This is the total of state and county sales tax rates. 23 2021 4275000 707 Deer Trail.

Cook County Property Tax Bills In The Mail This Week

Here is a list of all the county recorder offices and their contact information for your convenience.

. Box 4203 Carol Stream IL 60197-4203. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. Heres how Dupage Countys maximum sales tax rate of 105 compares to other.

DuPage County collects on average 171 of a propertys assessed fair market value as property tax. Average Sales Tax With Local. District Outside Business District 775 775 100 No change 875 775 Business District Aurora DuPage County Aurora Business.

Ad Lookup Sales Tax Rates For Free. Moore Cook County Recorder. 250000 x 33.

Dupage County Has No County-Level Sales Tax. DuPage County Board Chairman Dan Cronin is proposing a 4655 million spending plan that anticipates further gains in sales tax receipts and holds the line on property taxes in the coming fiscal year. By law the assessor can use a maximum of 13 of your homes fair market value in determining your DuPage County real estate or property taxes.

26 2021 4099000 327 East 3rd Street. Reference the Sample tax return for registration of Liquor Tax Return. Interactive Tax Map Unlimited Use.

The Illinois state sales tax rate is currently. 1304 rows 2021 list of illinois local sales tax rates. All retailers and servicepersons conducting business.

For retail sales made up to and including June 30 2021 DuPage County imposes the County Motor Fuel Tax at a rate of four and onetenth cents 41 per gallon. 16 2021 3750000 15W151 60th Street. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

There are a total of 495 local tax jurisdictions across the state collecting an average local tax of 1904. County Farm Road Wheaton IL 60187. DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order of median property taxes.

16 2021 3750000 15W151 60th Street. While many counties do levy a countywide sales tax Dupage County does not. The December 2020 total local sales tax rate was also 7000.

The equalization factor currently being assigned is for 2021 taxes payable in 2022. 14 2021 3550000 634 West Hickory Street. The 2018 United States Supreme Court decision in South Dakota v.

The Dupage County sales tax rate is. DuPage County Collector PO. COOK COUNTY RECORDERS OFFICE.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. The Tax Sale will be held on November 17 2021 and 19th if necessary in the auditorium at 421 North County Farm Road Wheaton Illinois 60187. What is the County Motor Fuel Tax rate in DuPage County.

2021 Rate Change NEW Combined rate beginning January 1 2022 Type of Local Tax. Sales Tax Rate Change Summary Effective January 1 2022 To. The base sales tax rate in dupage county is 7 7 cents per 100.

The current total local sales tax rate in DuPage County IL is 7000. DuPage County IL Government Website with information about County Board officials Elected Officials 18th Judicial Circuit Court Information Property Tax Information and Departments for Community Services Homeland Security Public Works Stormwater DOT Convalescent Center Supervisor of Assessments Human Resources. The part of naperville in.

The minimum combined 2021 sales tax rate for Dupage County Illinois is. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. The Illinois sales tax of 625 applies countywide.

28 2021 3650000 418 South Park Avenue. Effective July 1 2021 DuPage County has imposed the County Motor Fuel Tax at a rate of eight cents 8 per gallon. This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes.

Illinois has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 475. Last years equalization factor for the county was 10000. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

Assessments in DuPage County are at 3348 percent of market value based on sales of properties in 2018 2019 and 2020.

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Illinois Sales Tax Guide For Businesses

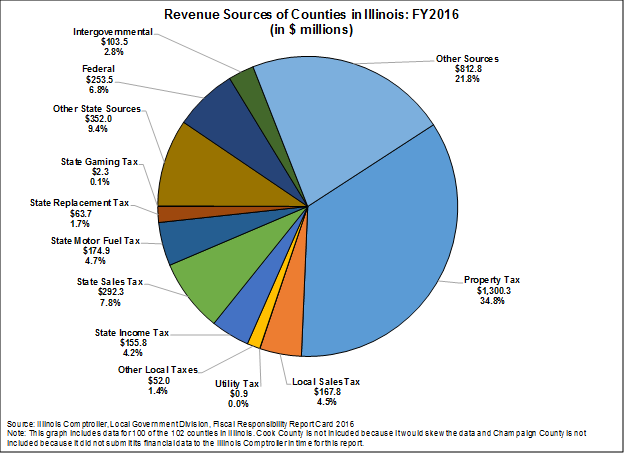

An Examination Of Counties In Illinois The Civic Federation

Property Tax Village Of Carol Stream Il

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Property Tax Village Of Carol Stream Il

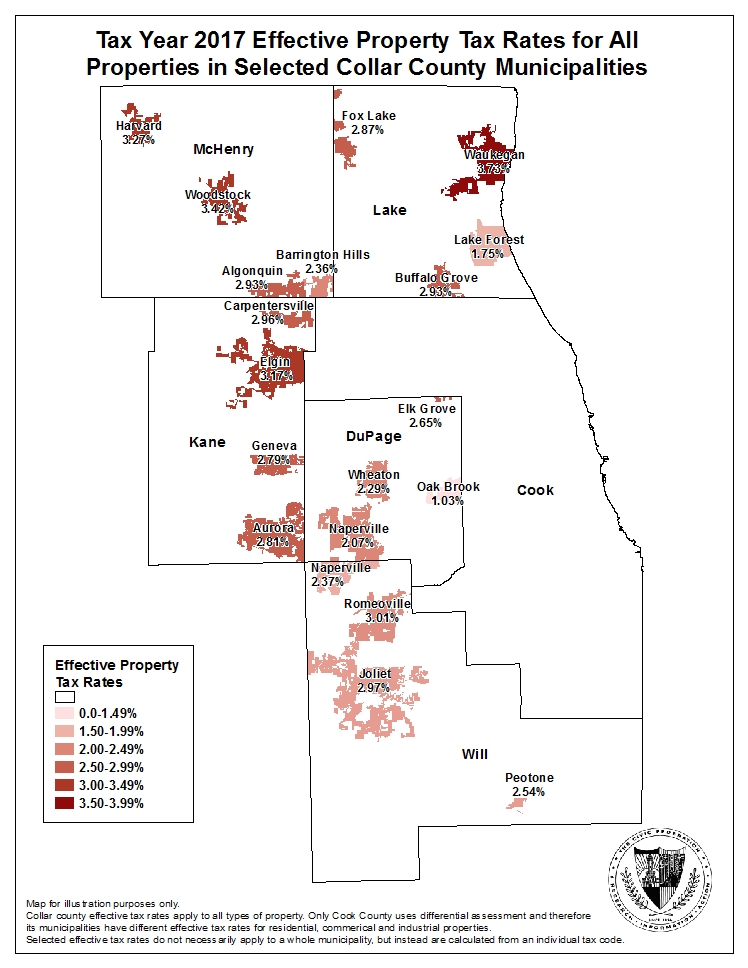

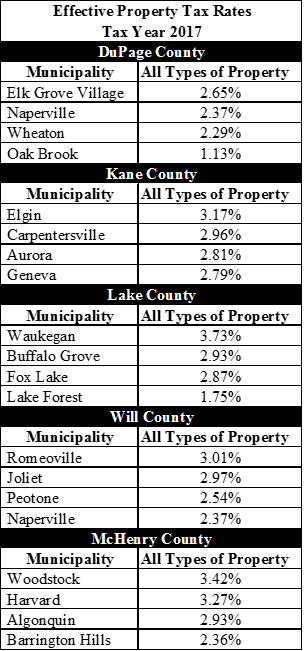

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Downers Grove 24th Highest Taxed Illinois Municipality In 2021 Dupage Policy Journal

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties

Tornado The First Significant Twister To Hit Dupage County In Decades Nbc Chicago

Du Page County Il Number Of Private For All Industries In Dupage County Il 2022 Data 2023 Forecast 1990 2021 Historical

Dupage Sales Tax Reduction Makes Buying A Car Cheaper

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation